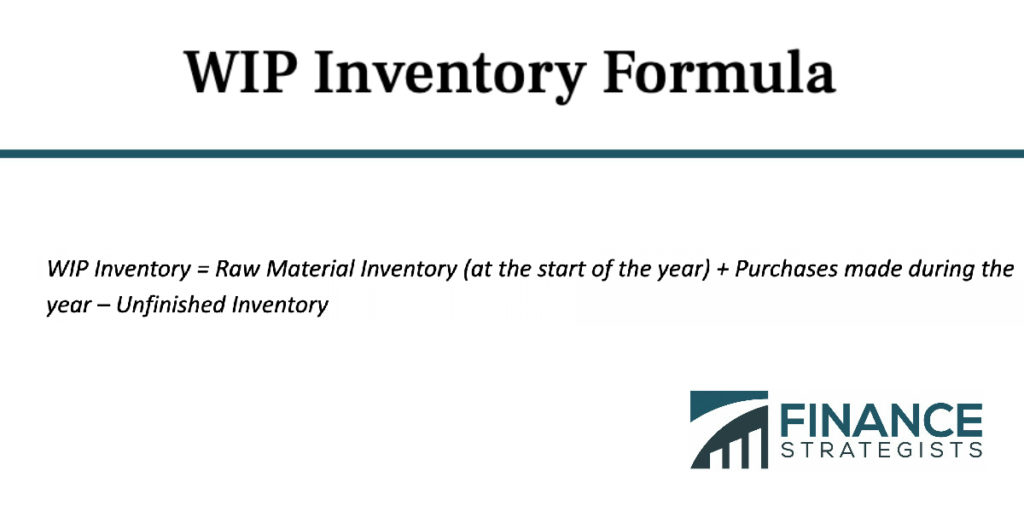

work in process inventory balance formula

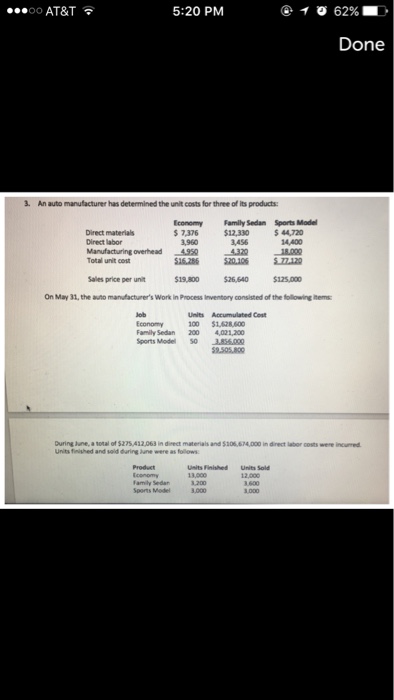

Though some within supply chain management do make a small distinction between them. During April the following costs appeared in the Work in Process Inventory account.

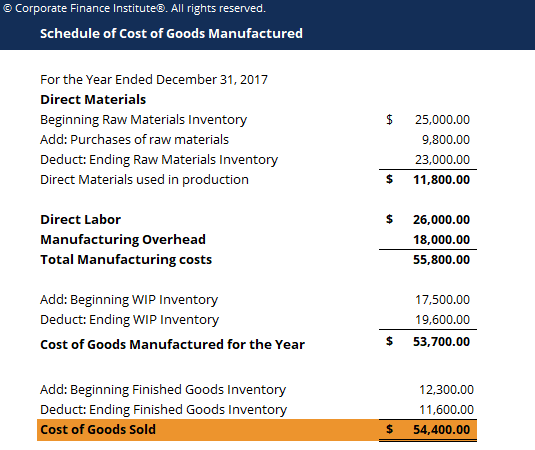

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Let say company A has an opening inventory balance of 50000 for the month of July.

. Materials as well as the price of transforming these materials into the finished product direct labor expenditures and manufacturing overheads are all included in this category of costs. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Charleston Company uses a job-order costing system.

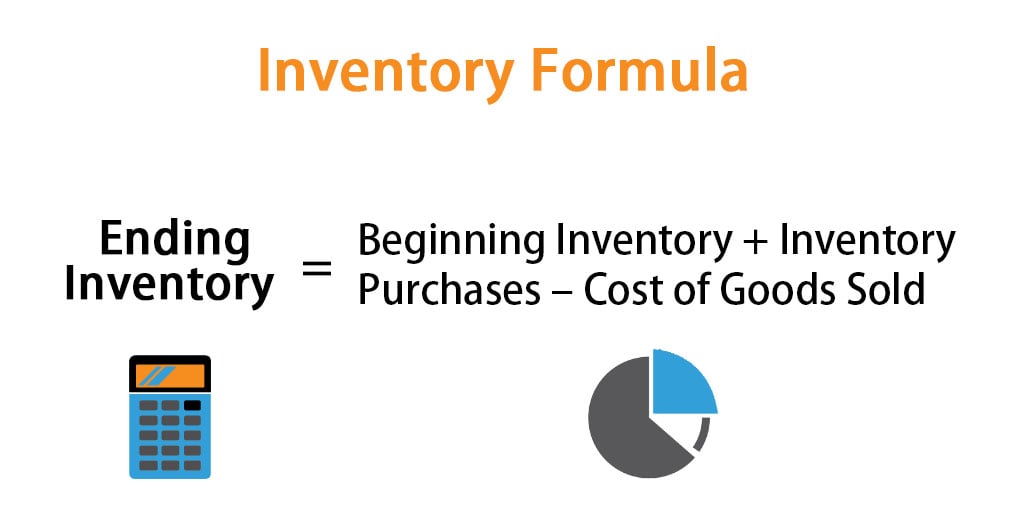

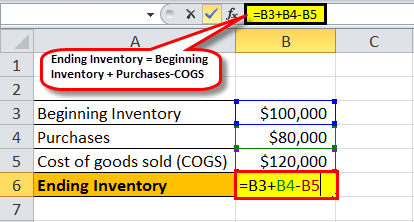

Ending Inventory Beginning Balance Purchases Cost of Goods Sold. Beginning balance 24000 Direct material used 70000 Direct l. Take a look at how it looks in the formula.

Work in process inventory formula. WIP Inventory amount Beginning Work in Process Inventory Manufacturing Costs Cost of Manufactured Goods Work in Process VS Work in Progress. Has a beginning work in process inventory for the quarter of 10000.

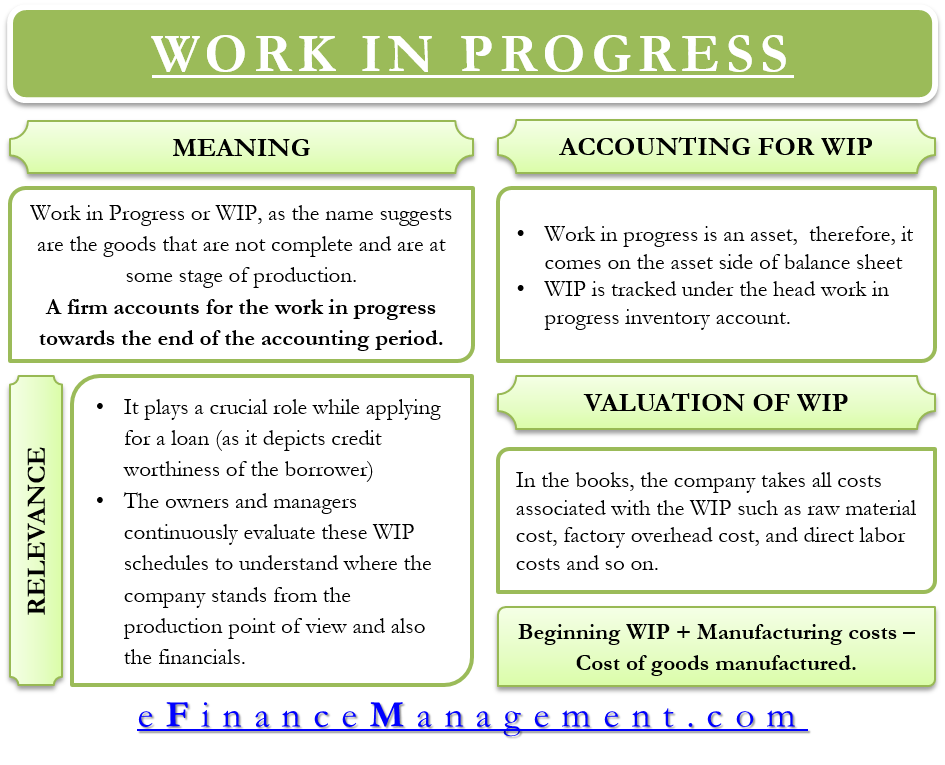

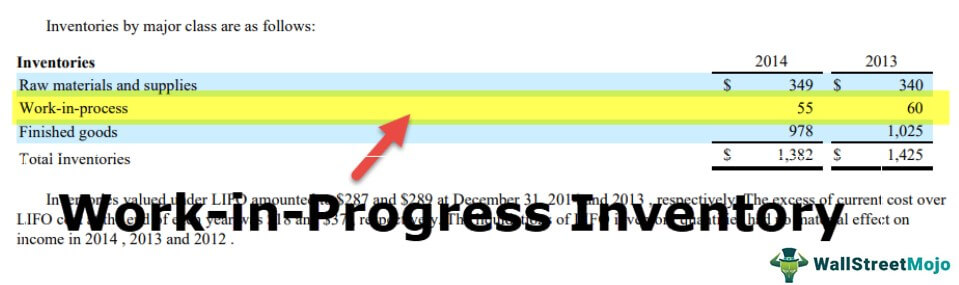

Some folks refer to work in process inventory only in the context of production operations that move along relatively quickly. On a balance sheet work in progress is considered to be an asset because money has been spent towards a completed product. How to Calculate Work-in-Progress.

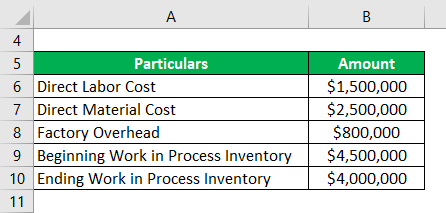

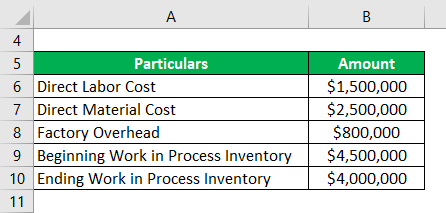

Ending WIP Beginning WIP Materials in Direct Labor Overheads - COGM Ending WIP 25000 40000 10000 5000 - 45000 Ending WIP 35000. Formulas to Calculate Work in Process. Work in process inventory calculations should refer to the past quarter month or year.

And changes in volume of production and inventory levels also tend to be small. The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. Additionally items that are considered work in progress may depreciate or face a lower demand from consumers once they have been completed.

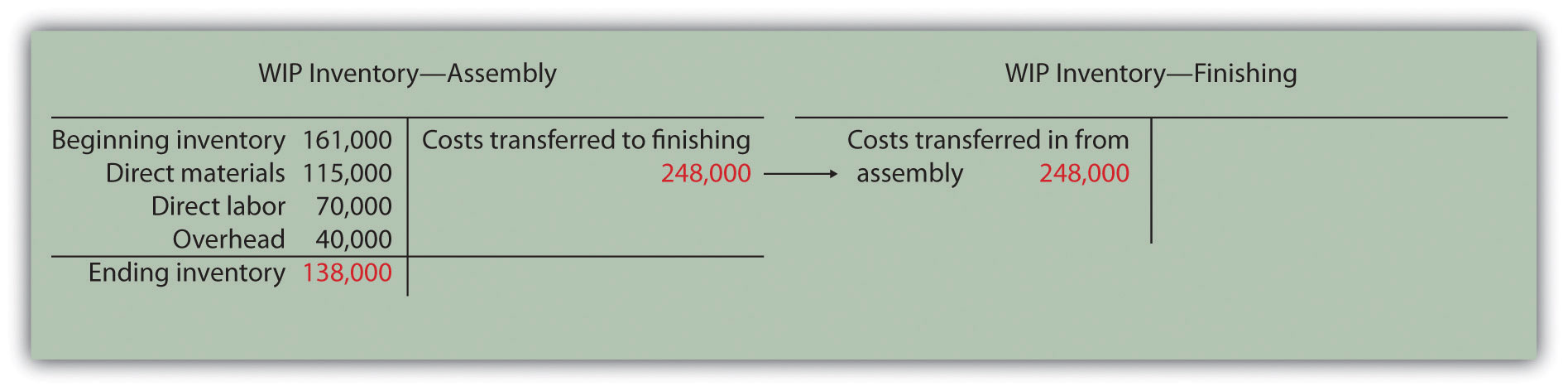

How do you calculate work in process inventory. FG finished goods WIP work-in- process Transferred to. The WIP figure reflects only the value of those.

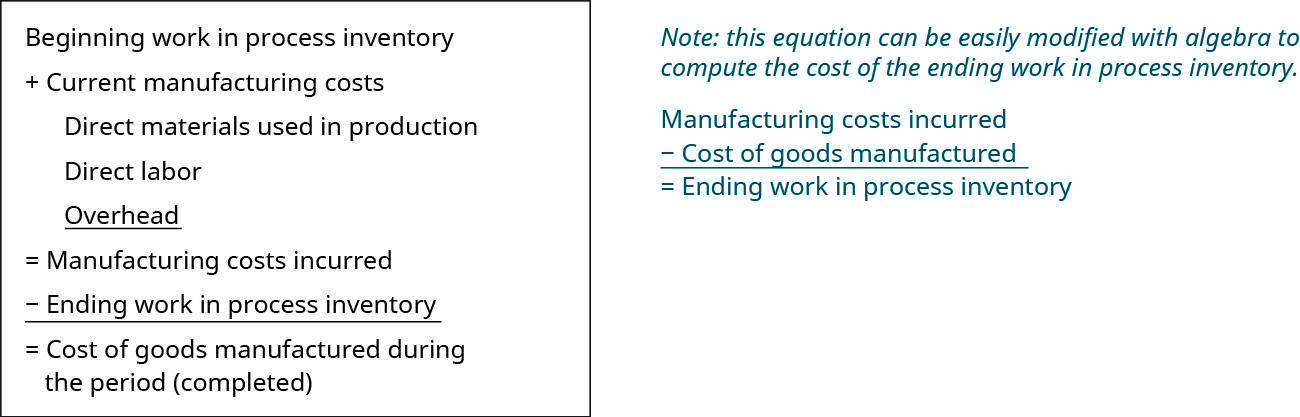

Higher sales and thus higher cost of goods sold leads to draining the inventory account. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. Ending Inventory Beginning Inventory Inventory Purchases Cost of Goods Sold.

How to Calculate Ending Work In Process Inventory. The formula is as follows. The formula for this is as follows.

Your WIP inventory formula would look like this. This means that Crown Industries has 10000 work in process inventory with them. Every dollar invested in unsold inventory represents risk.

For the exact number of work in process inventory you need to calculate it manually. Work in process inventory and work in progress inventory are interchangeable phrases for the most part. Work in process inventory 60000.

Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have. C m cost of manufacturing. And C c cost of goods completed.

The value of the partially completed inventory is sometimes also called goods in process on the balance sheet. The work in process formula is. So to calculate ending inventory for the period we will start will the inventory which is currently listed on companys balance sheet.

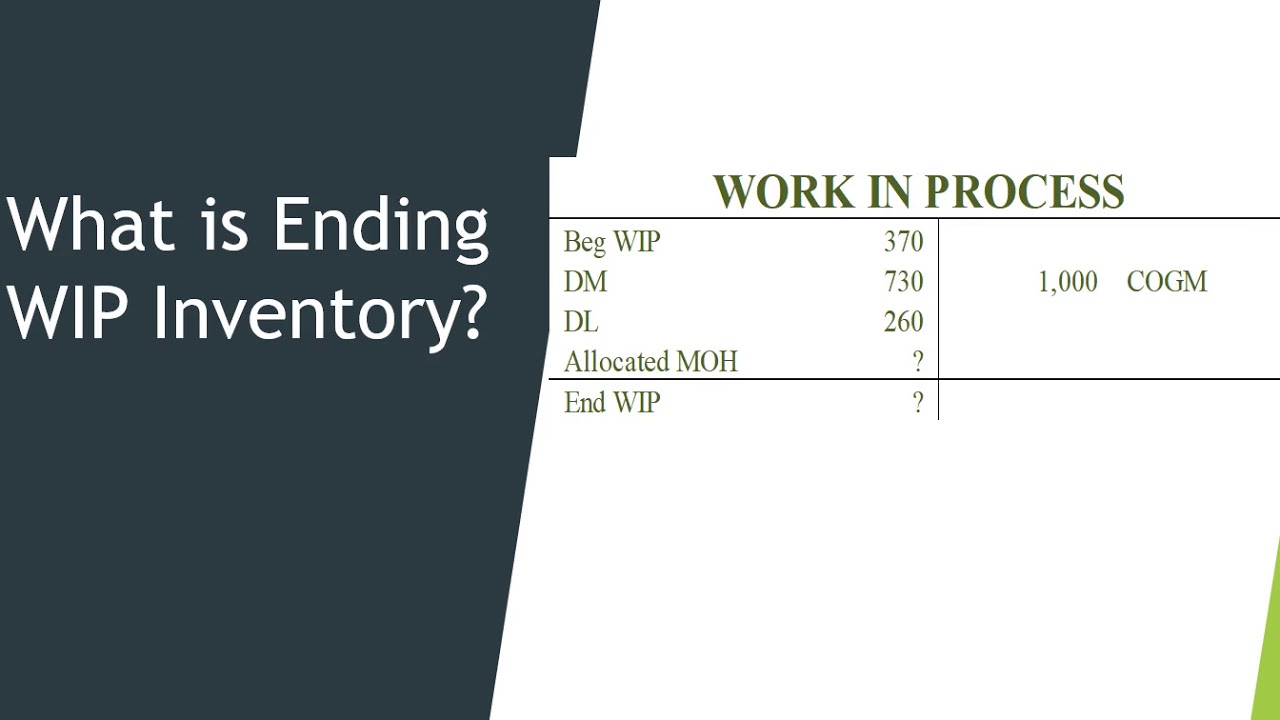

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. Determine the formula then enter the amounts to calculate the amount transferred to Finished Goods Inventory Enter O for zero balances.

The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process. Work in progress also called work in process is inventory that has begun the manufacturing process and is no longer included in raw materials inventory but is not yet a completed product. Work in process operating inventory goods in process raw materials used during the period direct labor during the period factory overhead for a period ending inventory.

8000 240000 238000 10000. It is generally considered a manufacturing best practice to minimize the amount of work-in-process in the production area. Keep in mind this value is only an estimate.

Work-in-process is an asset and so is aggregated into the inventory line item on the balance sheet usually being the smallest of the three main inventory accounts of which the others are raw materials and finished goods. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. If the June 1 balance in Work-in-Process Inventory---Finishing is 0 and the June 30 balance is 30000 what amount was transferred to Finished Goods Inventory.

Under this method the cost of completed units is. However by using this formula you can get only an estimate of the work in process inventory. The formula for WIP is.

WIP e WIP b C m - C c. Where there is opening work-in-progress in a process that is not the first stage of the production process the following special consideration is required. Add the new purchases and subtract the Cost of goods sold.

Imagine BlueCart Coffee Co. Lets use a best coffee roaster as an example. 10000 300000 250000 60000.

Work-in-Process Inventory Average Work-in-Process Inventory during the year. The conceptual explanation for this is that raw materials work-in-progress and finished goods current assets are turned into revenue. In this example the beginning work in process total for June is 50000 the manufacturing costs are.

WIP b beginning work in process. In this equation WIP e ending work in process. Work in process inventory refers to materials that have been partially finished throughout the course of a production cycle.

The ending work in process is now calculated using the work in process inventory formula as follows. The formula for ending work in process is relatively simple.

Ending Work In Process Double Entry Bookkeeping

What Is Work In Process Wip Inventory How To Calculate It Ware2go

What Is Work In Progress Wip Finance Strategists

Solved Calculate The Ending Work In Process Inventory Chegg Com

Work In Progress Meaning Importance Accounting And More

Work In Process Wip Inventory Youtube

Inventory Formula Inventory Calculator Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Ending Inventory Formula Step By Step Calculation Examples

Ending Inventory Formula Step By Step Calculation Examples

Cost Of Goods Manufactured Formula Examples With Excel Template

Wip Inventory Definition Examples Of Work In Progress Inventory

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Beginning Work In Process Inventory Business Accounting

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com